Split payments on the debit card, now with Pay-in-4

Introducing the most preferred BNPL loan setting, available for the first time to financial institutions

Want to grow accounts?

Unlock BNPL on your debit cards today.

What is equipifi Pay-in-4?

Supercharge your debit cards with the power of fintech

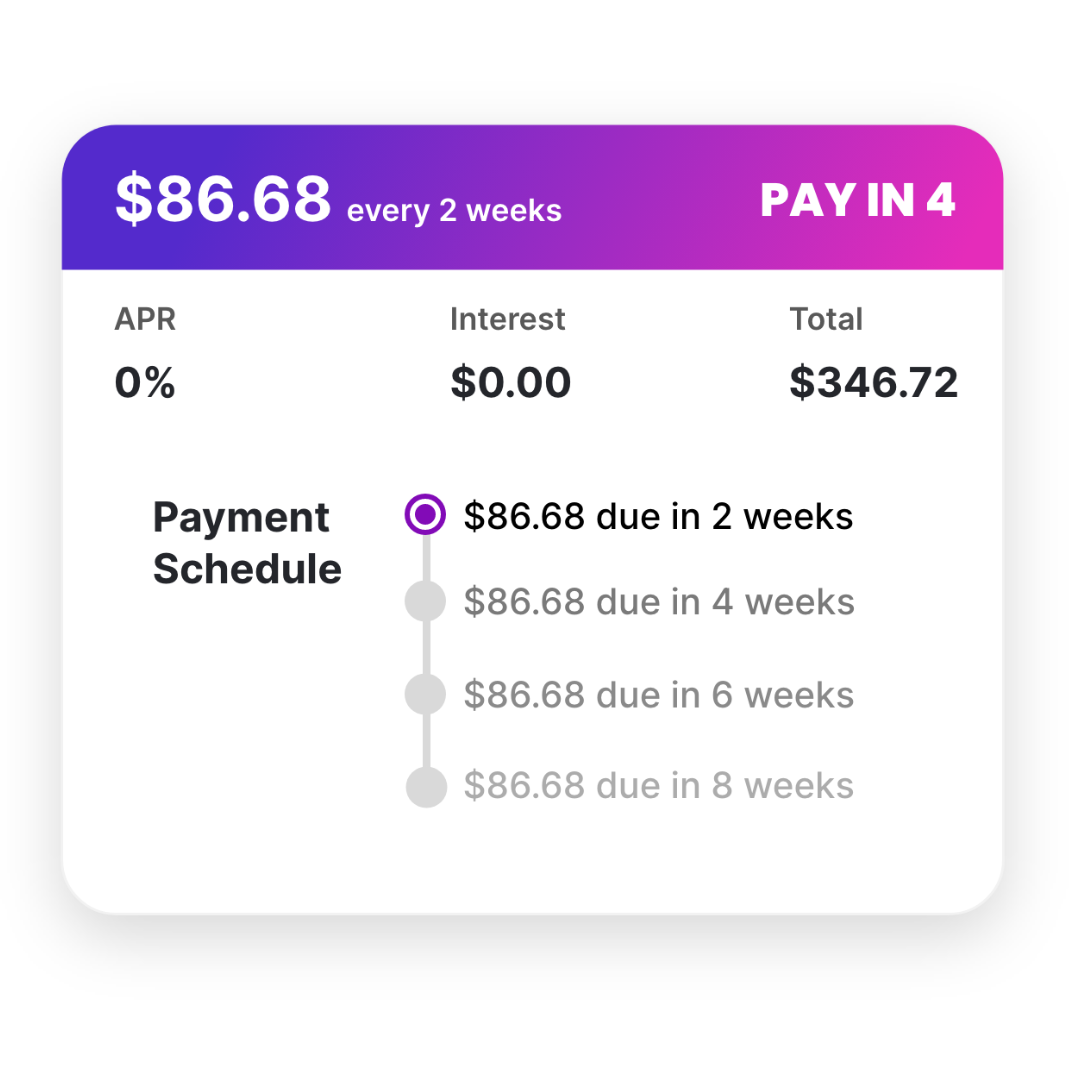

4 equal payments

Pre-qualified BNPL offers are displayed in your banking app, ready to be accepted as Pay-in-4 or longer term installment plans.

Rates that you set

Select your preferred interest rate for specific terms and risk profiles to increase adoption and profitability, at as low as 0%.

Smart + Personal

No application. No credit check. No downloads. Extend offers aligned with consumer financial health and tailored to their transactions.

Trying is believing

Give your cardholders an easy way to experience your BNPL solution

Previously only available from 3rd-party BNPL providers, Pay-in-4 is attractive to first time BNPL users due to the clarity of its terms and short repayment timeline. Now you can offer it too.

Got questions? We got answers!

Here are some FAQs

Who is eligible to use Pay-in-4?

Your institution sets the parameters. equipifi generates offers based on account level and transaction level rules set by you.

How are payments made for Pay-in-4 BNPL loans?

equipifi presents BNPL offers to eligible debit cardholders with an existing checking account. As with all loans in the BNPL experience, cardholders can choose auto-pay or manual pay while confirming terms.

How many Pay-in-4 loans can a cardholder have?

Your institution can choose how many each cardholder qualifies for by both quantity of active plans, total balance of outstanding plans, and the total monthly payments required by the cardholder. Please contact your account executive to learn how to adjust your settings.

Where can I find Pay-in-4 on my banking app?

Pay-in-4 can be made available on the offer screen after cardholders have selected an eligible transaction to convert into installment plans. equipifi has partnered with many leading digital banking providers to ensure offers are visible through your banking app.

Can we use Pay-in-4 as an acquisition tool?

Yes. You can configure equipifi to enable Pay-in-4 offers for new accounts based on your deposit and card acquisition strategy.

Do I have to be an equipifi partner to enable Pay-in-4?

Yes. equipifi's BNPL solution is embedded in the digital banking platform and connected to the banking core. You must be an existing equipifi customer to enable Pay-in-4.

If you are already an equipifi customer, please contact your account representative to learn more.