Elevate your member experience with Buy Now, Pay Later

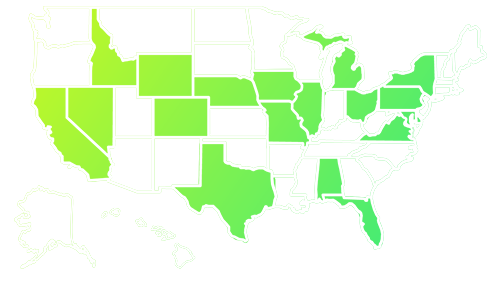

70+ CUs have already partnered with equipifi and 600 more are actively exploring BNPL for their members in 2026.

.jpg)

equipifi is an award winning CUSO, trusted by credit unions everywhere

It's time to level upIntroducing

purchase financing to your banking experience

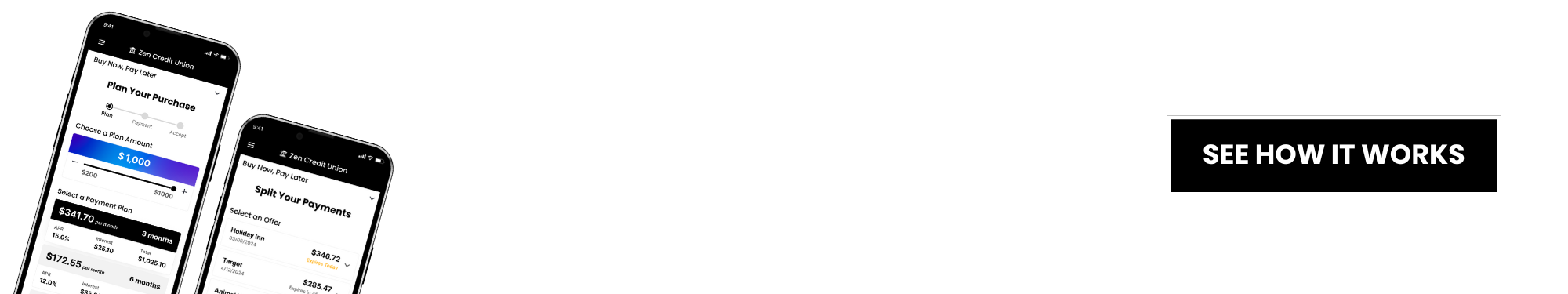

Step 1

Offers are generated based on member data, transaction data, and BNPL parameters set by the credit union.

Step 2

The member is presented with BNPL offers within their existing online banking experience.

Step 3

BNPL is already connected to the member's checking account. The member can select how to pay off loans in set number of installments.

Step 4

The member can choose between automatic or manual payments.

Step 5

The member views and accepts their pre-qualified BNPL offers in less than 30 seconds.

Step 6

Purchase amount is credited to the member's checking account and BNPL loan is written onto the banking core. Offers are regenerated.

NO CREDIT CHECK. NO APPLICATION. It's purchase financing on-the-go

Grow loan volume & activity

Generate pre-qualified BNPL offers at scale with no manual intervention from the financial institution

Attract new accounts

Drive engagement and grow accounts by launching flexible financing, with funds deposited in moments

Drive interest income

Grow revenue by providing personalized installment loans to account holders when they need funds

Increase engagement

Turn every purchasing occasion into a positive budgeting experience, centered around your digital banking app

“We went live with equipifi and haven't looked back. Supporting members with short-term liquidity and increasing our loan growth. Thanks equipifi!”

Bryan Thomas

Chief Executive Officer

![]()

Launching Your BNPL SolutionHere's how it works

STEP 1Assess Your Data

Are your members using 3rd-party BNPL solutions? How many BNPL loans can you expect to write every month? How much growth in revenue can you anticipate every year?

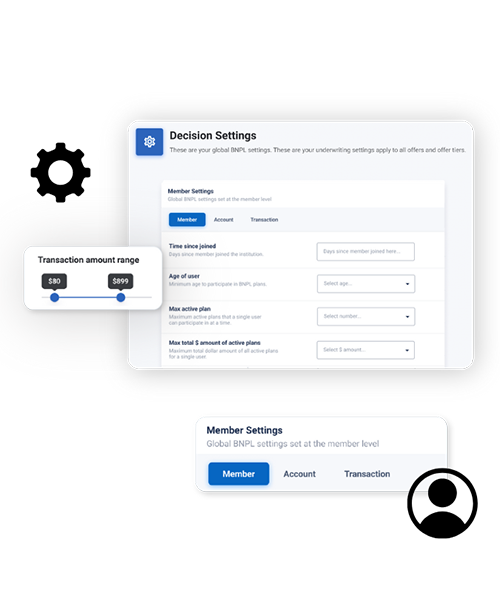

Step 2Explore Your Parameters

equipifi allows credit unions to fully customize loan parameters based on growth strategy and risk tolerance.

If you are new to BNPL, check out equipifi’s out-of-the-box settings and learn how other credit unions have leveraged BNPL for success.

Step 3Launch Your Experience

equipifi is integrated with major banking cores and digital platforms and can quickly get most credit unions up and running with their BNPL solution.

Our Go-To-Market team is ready to support you with a fully white label experience. From selecting your parameters, to branding the solution, to driving engagement.

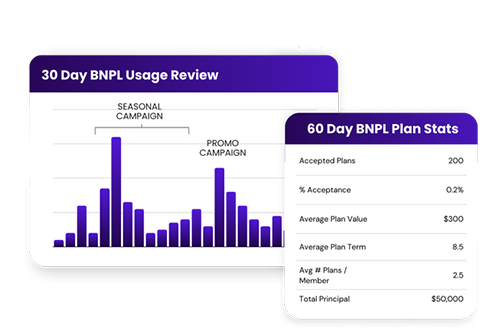

Step 4Learn & Grow Together

Get equipifi’s BNPL experts on your team who are committed to helping your new program succeed.

equipifi’s post-launch check-ins provide usage insights, engagement campaigns, and optimization strategies to help you grow.

Case Study

Within three months, ACU of Texas’ BNPL saw higher member usage than 3rd-party BNPL use combined

“We wanted to meet our members where they are. BNPL is a sticky product that our members would use and appreciate safely in our home banking, versus one of the third-party options.”

Eilene Markus, SVP of Support Services

accepting plans after viewing offers

plans per engaged member

total active loan value per member

Are you ready to launch?