It can be tricky to evaluate innovative new lending products. Buy Now, Pay Later (BNPL) isn’t a new concept and consumers love to use it, but many financial institutions are still proceeding with caution before launching this payment preference to their cardholders.

And no wonder. Despite its success, regulatory agencies and press have shined a spotlight on 3rd-party BNPL providers, exposing the absence of consumer protection guardrails. Additionally, comparisons of BNPL to payday loans also position it as a program designed for the financially fragile. If that were the case, how could a financial institution launch BNPL as a product if it may not be beneficial for consumers?

It’s important to assess the risk to financial institutions and cardholders alike when considering a new lending product. So let’s take a look at the data:

BNPL is low risk, especially compared with credit cards

In 2022, the CFPB’s study on the five largest 3rd-party BNPL providers found a charge-off rate of 3.8 percent. Since then, these numbers have steadily decreased. Affirm’s data shows their BNPL loans have been performing better year over year, with 30+ day delinquency rates lower than major credit card issuers today. In fact, Klarna’s Q2 credit loss rate in 2023 was only 0.41%.

BNPL from financial institutions are also low risk. equipifi data shows running aggregate delinquency rates at 1.35 percent, and similar to Affirm, this rate is decreasing as well.

Compare this to the national credit card delinquency rate of 2.58 percent and charge off rate of 3.38 percent in Q2 2023. When using this as a benchmark, we can see that BNPL programs are not materially riskier than credit cards.

BNPL does not pose a significant risk to the issuer.

BNPL is for consumers across income levels

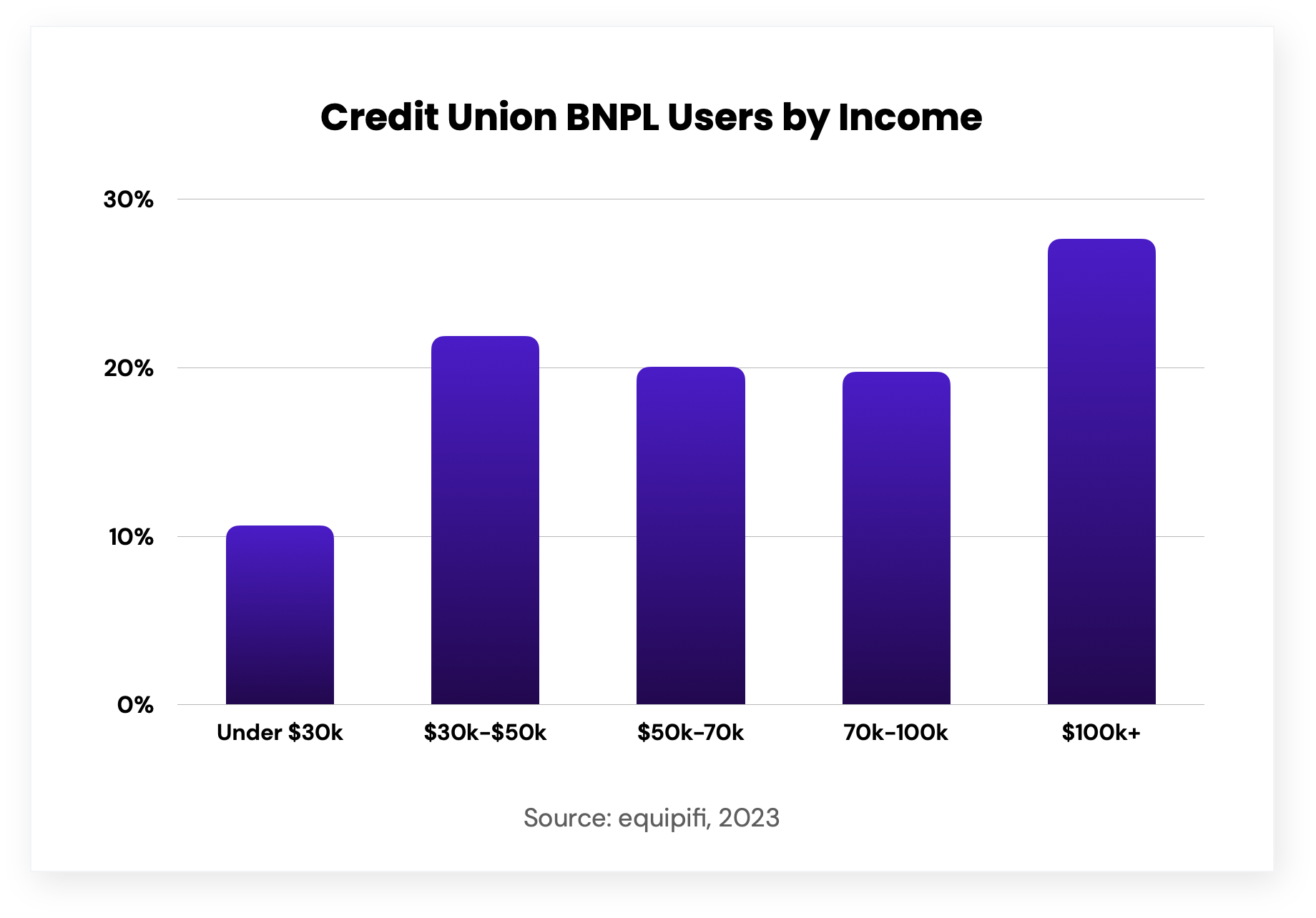

What about the claim that BNPL is only used by the financially fragile? When it comes to 3rd-party BNPL, the Federal Reserve found in 2022 that there was a correlation between income level and likelihood of BNPL usage. Higher income borrowers were more likely to be heavy BNPL users while lower income borrowers were more likely to be light BNPL users.

equipifi data shows that BNPL programs from financial institutions are utilized by cardholders of all income levels, with use cases ranging from everyday purchases to medical bills. Meaning, while consumers can find BNPL beneficial when they are experiencing financial duress, they also use it as a budgeting tool.

There is no one-size-fits-all approach

Your BNPL program is a tool for you as a financial institution to serve your cardholders and strategically reach your institutional goals. On an industry level, BNPL programs are low-risk and show broad adoption. In fact, some financial institutions accept slightly higher charge off rates to encourage engagement and grow deposit relationships. There is no one-size-fits-all approach.

So look for a BNPL product that will allow you to set your own parameters and help you manage your own risk. Make adjustments so that your cardholders receive the type of BNPL offers that best reflect where they are in their financial journey.

SHARE