At its core, BNPL offers loans to members to expand their buying power. Its primary KPIs are the same as that of many other types of loans, designed to make sure that each loan made is sustainable and that throughput confirms the strategic value for both your members and your institution.

In addition to the metrics that measure BNPL as a product offering, offering your members BNPL plans can provide your institution with additional way to assess member satisfaction and health. Historically, those institutions that focus on simplifying their member’s experience (i.e. lowering their members’ effort to use their products) are best poised to increase satisfaction and loyalty, translating to higher retention than their competitors.

Here are a few metrics your bank or credit union should be tracking, how they are calculated and, most importantly, how to leverage them in the context of BNPL.

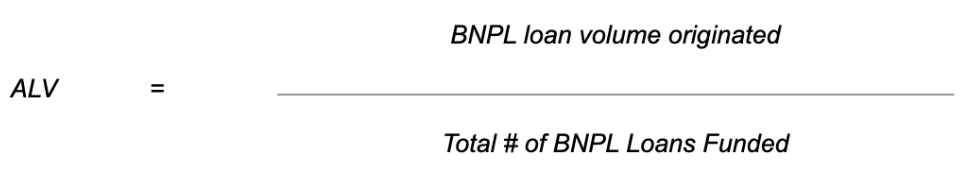

1. Average BNPL Loan Value

Average BNPL loan value and its change overtime tells you at what price point your members begin to require help to stretch cash availability. This can also inform you on ways to refine your decision parameters to better accommodate your members' needs.

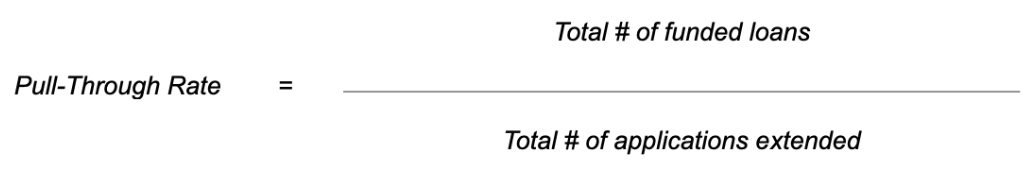

2. Pull-Through Rate

BNPL pull-through rate from financial institutions is an indicator of how willing your members are to accept BNPL from you.

3. Application Approval Rate

Ok, this was just an effort to be tricky. There are no applications - instead these are preapproved firm offers of credit. You as a financial institution have access to the necessary input to decide if a BNPL plan should be extended to a member before you do so.

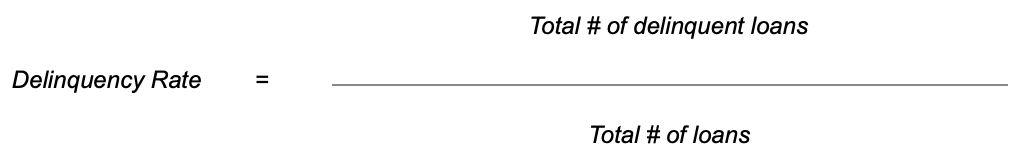

4. BNPL Delinquency Rate

You’re extending pre-approved BNPL offers based on parameters you have set to calibrate for delinquency risk. The rate at which members default on their loans can tell you if your parameters and assumptions need adjustment.

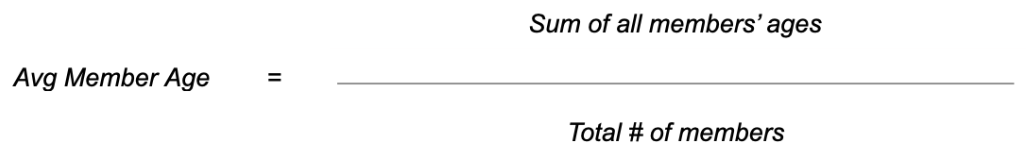

5. Average Member Age

What is the average age of your members? This is something that every bank and credit union pays attention to, but not enough literature exists to discuss. The ideal average member age may vary from institution to institution, but should reflect the demographic you serve. If your average member age increases significantly, it’s an opportunity to reflect on if your financing solutions are not attractive to younger generations.

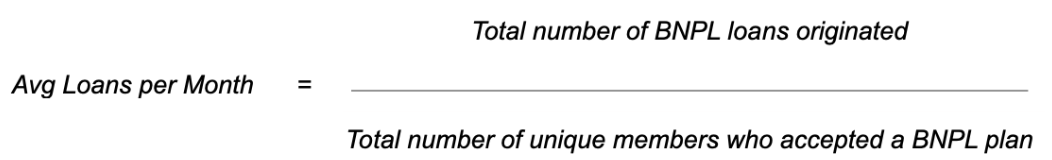

6. Average Loans per Month

How often do your members use BNPL every month? There is no right answer and your institution should decide strategically what makes the most sense.

Here's some additional insight: Fintech BNPL solutions show that their consumers most commonly use BNPL twice a year, but 41 percent use it once every 1-3 months. Fintech BNPL also doesn’t cover recurring transactions such as utility or rent. There are a number of inputs we use within our decision engine to better calibrate parameters within our automated BNPL platform, while allowing you as the institution to have administrative control over these inputs. With that said, we recommend that banks and credit unions aim for one loan a month as a baseline when monitoring the overall success of your BNPL program.

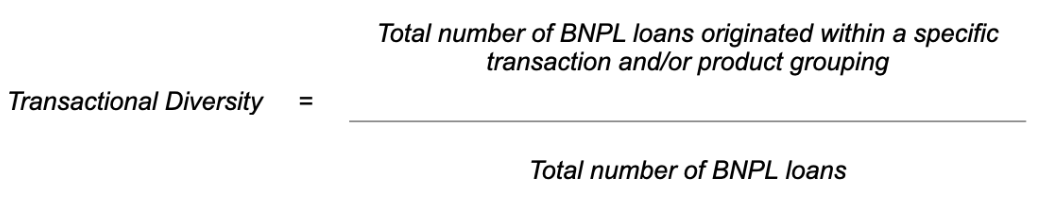

7. Transactional Diversity

It is important to understand which transaction types are providing the greatest benefit to your members. Categories such as MCC, product types, online versus brick-and-mortar, seasonality, and other metrics can help identify specific trends and provide a better understanding of your members' behavior.

In addition to these metrics, there are a number of other key data points that can provide tremendous insight into the success of a BNPL offering. The tricky part is understanding the data in a way that can be used by your institution to adjust your services and offerings. That’s where equipifi comes in. Interested in how we do it? Don’t hesitate to reach out as we’ll be happy to show you.

So, what metrics do you track?

SHARE