In the blink of an eye, we’re nearing Black Friday again.

The five days from Thanksgiving to Cyber Monday sit at the heart of the holiday shopping season and are the most active commerce days of the year. The National Retail Federation expects 2025 holiday spending to exceed one trillion dollars for the first time. And as in previous years, Buy Now, Pay Later (BNPL) will play a significant role in how shoppers choose to pay.

For financial institutions, this is a pivotal moment.

With U.S. consumers facing tighter budgets due to the macroeconomic environment, demand for purchase financing will be higher than ever. equipifi reports that the number of financial institutions launching BNPL in-house has nearly doubled year over year. And according to a recent PayPal survey, more than half of shoppers plan to use BNPL this holiday season. Financial institutions that understand consumer needs and build a BNPL strategy now will carry that momentum into 2026. Those that don't may see their account holders turn elsewhere.

Here are our predictions for 2025’s holiday season:

- BNPL adoption will accelerate due to consumer demand

- Consumers want their real time purchasing power

- Bank BNPL providers will still have an advantage (for now)

BNPL adoption will accelerate due to consumer demand

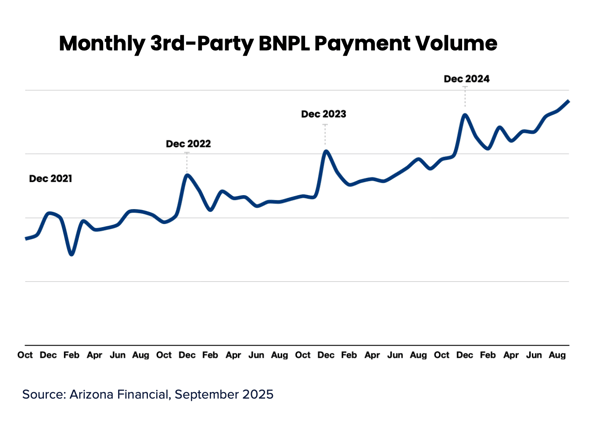

Holiday BNPL usage always surges, but this year stands out. BNPL adoption has not only increased, it is accelerating.

Eric Givens, SVP of R&D at Arizona Financial, has seen this trend firsthand. The credit union’s cards team has tracked 3rd-party BNPL activity since 2019. Growth was steady until 2024, and in 2025 the curve steepened noticeably. In fact, Eric notes that Arizona Financial’s 3rd-party BNPL activity in August has already surpassed December 2024.

Just as important, once consumers become comfortable using installments for holiday gifts and larger purchases, many continue spreading out payments year round. This raises the baseline for the following year. For financial institutions, now's the time to meet consumer demand, not just for the holidays but to capture long-term behavior.

Consumers want their real-time purchasing power

This year, holiday shopping is defined by flexibility, careful planning, and the need for more room in monthly budgets. eMarketer's analysis of October's Prime Big Deal Days shows consumers trading down to essentials and lower-cost alternatives. With less to spend, shoppers take more time to find the right purchases, resulting in a more complex buying journey.

Real-time purchasing power is a critical part of that journey. Just as shoppers look for discounts, they also want to understand what they can afford and whether flexible financing is available. BNPL providers have positioned themselves to deliver this clarity.

Financial institutions offering BNPL should understand that they are not only enabling a payment method, but are also becoming a source of real-time financial insight. Once a consumer starts tracking payments in their BNPL app, that app becomes another touchpoint for checking balances, planning cash flow, and budgeting. Over time, this can shift or reinforce where consumers anchor their primary financial relationship.

Bank BNPL providers still have an advantage

Today, BNPL has a similar year-over-year user retention rate across providers: around 80 percent. Despite rapid growth, BNPL still has room to expand. Many consumers are only beginning to fully understand the product, develop habits, and form preferences.

In 2024, Eric’s team at Arizona Financial began noticing early signs of 3rd-party BNPL brand loyalty. However, consumers still preferred their existing financial institutions. When the credit union launched its own BNPL program in March of 2025, member adoption was immediate and engagement was strong. More than 23 percent of members booked a loan after seeing its availability. equipifi's data show that this holds true across financial institutions, with an aggregate "look-to-book" conversion rate of 22 percent. Consumers continue to place trust in existing relationships, and find greater satisfaction using BNPL through a legacy brand.

However, this window of opportunity is limited. With a playing field still relatively level, financial institutions should act now before consumers look outside of their banking relationship for purchase financing.

How Financial Institutions Should Prepare

BNPL is increasingly part of how consumers manage their financial lives. Each use becomes an entry point into daily financial habits. When BNPL is integrated into a trusted banking app, consumers stay connected. When they turn to external BNPL providers, part of that relationship shifts away. And with fintech BNPL providers now offering savings accounts, debit cards, and deposit-building incentives, financial institutions have far more to lose by staying on the sidelines.

Here are some ways to approach your BNPL strategy this holiday season:

- Highlight the value of your BNPL program

Awareness alone can drive adoption today. Keep messaging simple: predictable payments, no credit check, no surprises. Pair that with the confidence of working with a trusted financial institution. - Extend BNPL visibility through January

January may be quiet for retail, but it is a major month for BNPL activity. Stay top of mind with post-season messaging. Some equipifi partners even offer the ability to convert 3rd-party loans into in-house loans for consolidation and better interest rates. - Consider offering pre-purchase BNPL

Many institutions already offer holiday loans, and pre-purchase BNPL serve a similar need. It also supports consumers who want clarity on their spending power before they shop, reducing stress, improving planning, and positioning the institution as a helpful financial guide.

Holiday 2025 is an important engagement period for financial institutions. The only wrong strategy is no strategy at all. To learn more about BNPL predictions for this season, check out my webinar with Eric Givens from Arizona Financial.

SHARE