BNPL: As Told By Financial Institutions

What is it like partnering with equipifi?

Thinking about BNPL but wondering what to expect? From our first hello to your integration and beyond, launching BNPL with us is so much more than just another software purchase. From all the subject matter expertise that you'll need to a true commitment to you and your account holders' success, this is what our financial institution partners say about working with us.

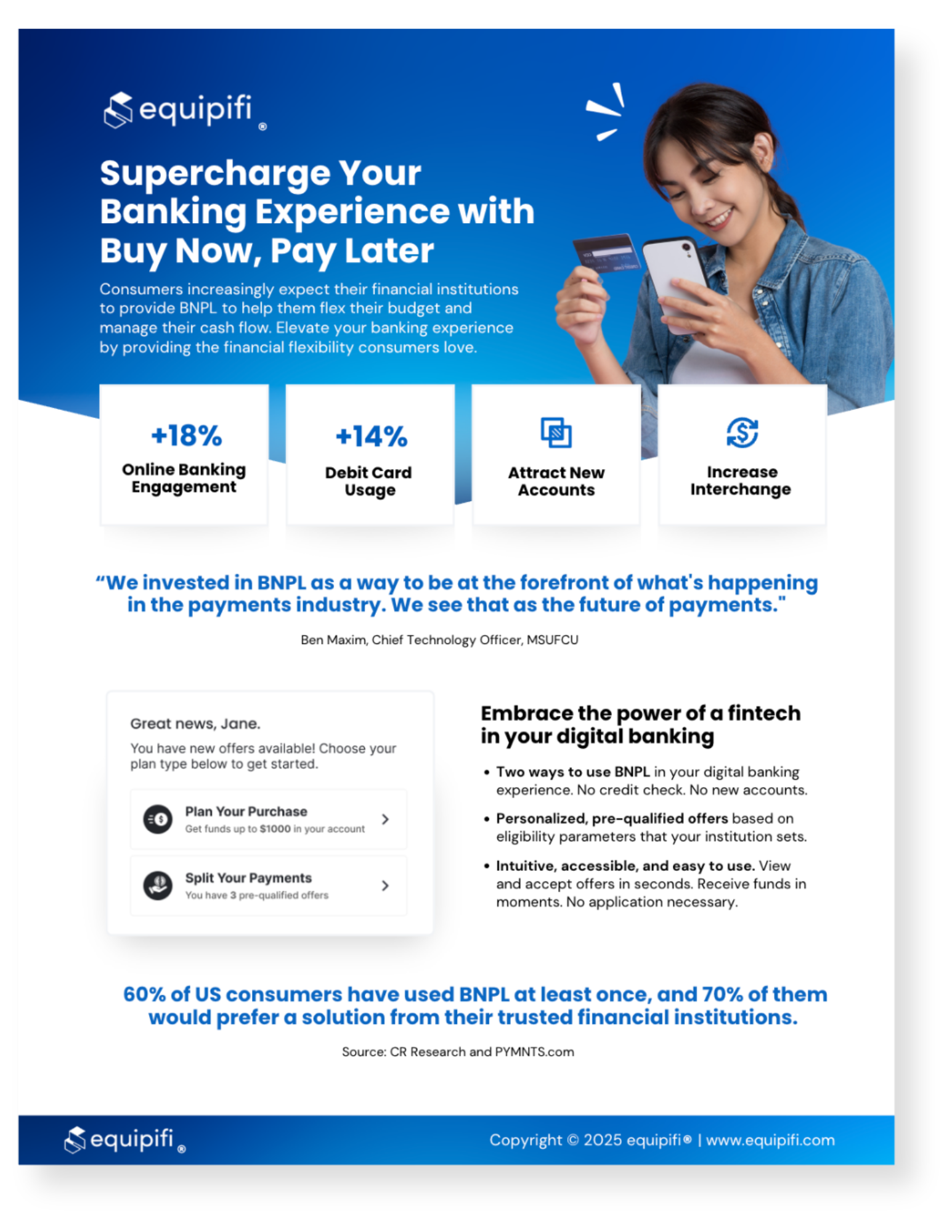

One Pager

Supercharge Your Banking Experience with Buy Now, Pay Later

Consumers increasingly expect their financial institutions to provide BNPL to help them flex their budget and manage their cash flow. Elevate your banking experience by providing the financial flexibility consumers love.

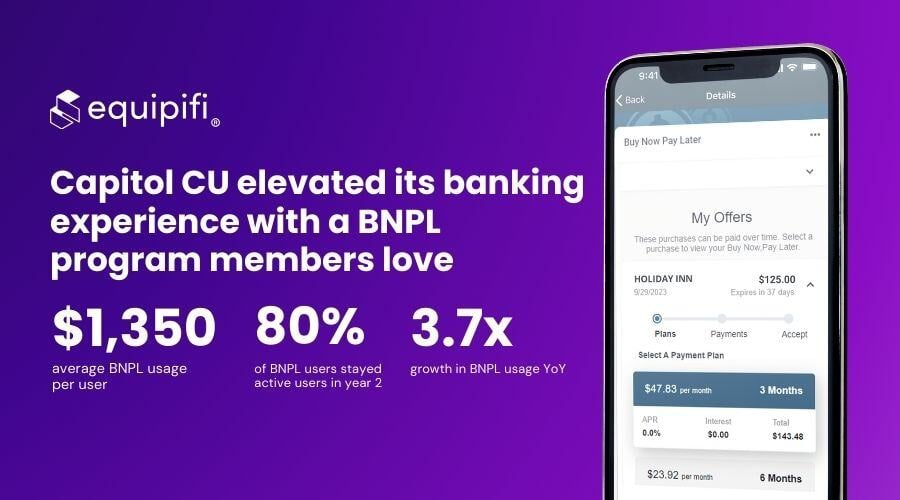

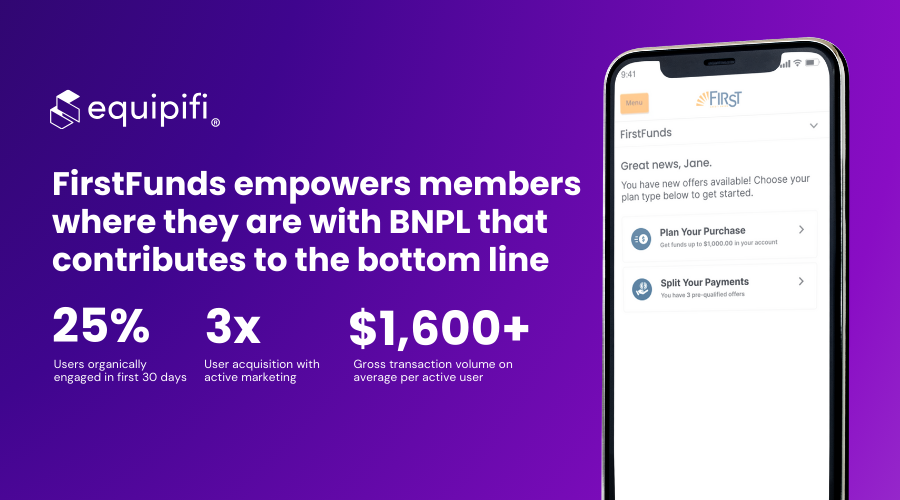

CASE STUDY

FirstFunds empowers members where they are with BNPL that contributes to the bottom line

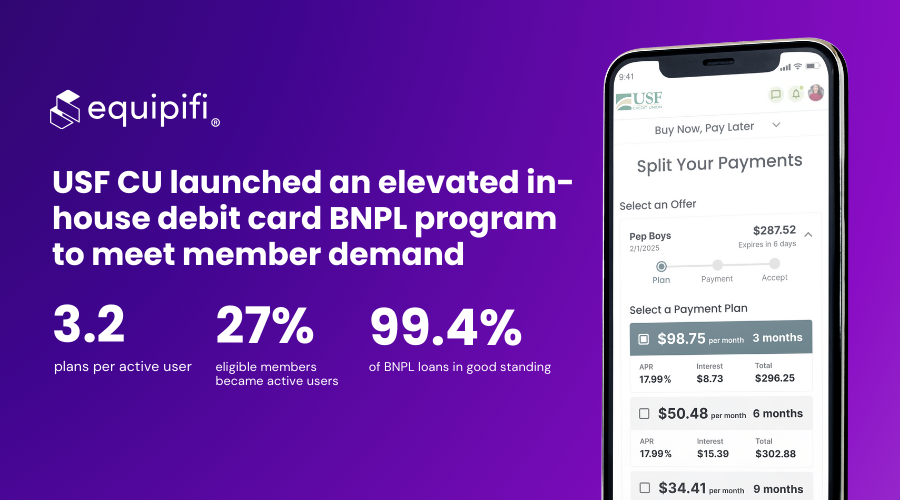

CASE STUDY

USF CU launched an elevated in-house debit card BNPL program to meet member demand

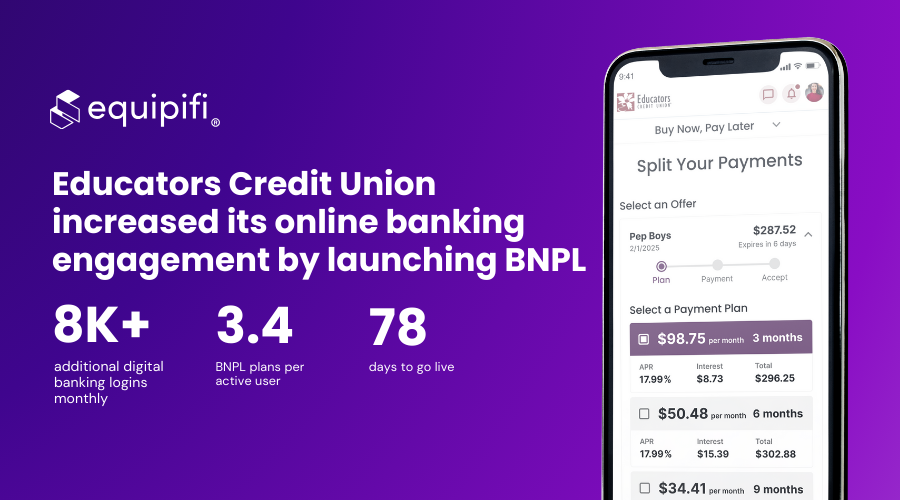

CASE STUDY

Educators Credit Union increased its online banking engagement by launching BNPL

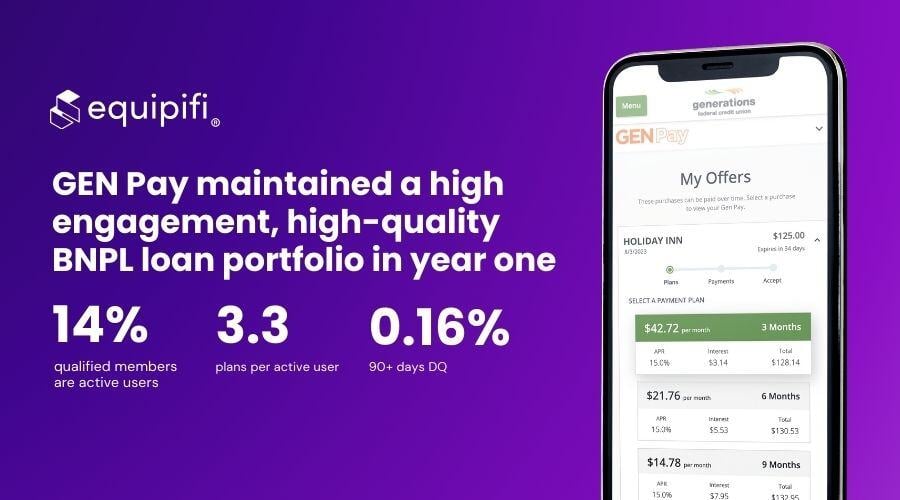

CASE STUDY

GEN Pay maintained a high engagement, high-quality BNPL loan portfolio in year one

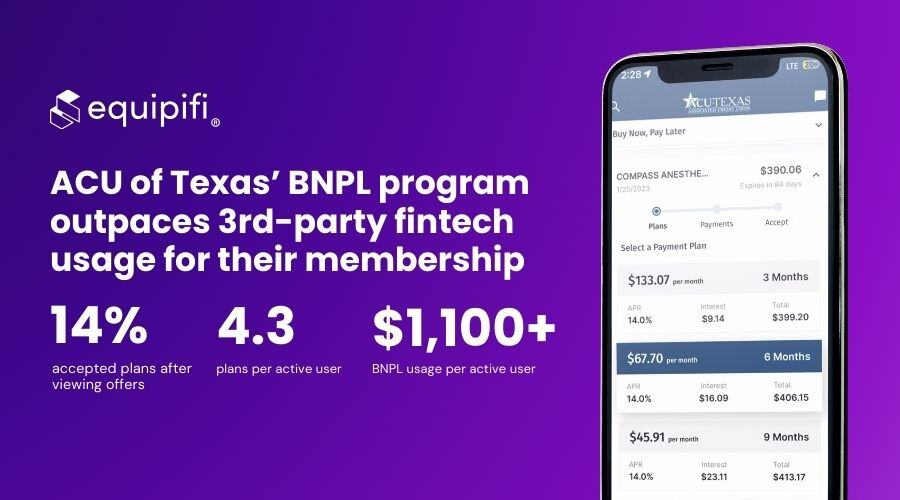

CASE STUDY

ACU of Texas’ BNPL program outpaces 3rd-party fintech usage for their membership

Insights and Innovation 2025

Understanding BNPL: The Lending Perspective

Hear from lending leaders across institutions on their BNPL journey and learn how they set their strategic goals, what they expected, and what they found.

Elevating the Digital Experience with BNPL

Three institutions, three different BNPL launches, and three sets of lessons. Explore how different credit unions approached adoption—and how they’re winning member engagement.

Q&A: BNPL and Credit Scores

What have banks and credit unions been asking about BNPL and its impact on building creditworthiness?

Want to learn more? Let's chat!

We're happy to answer your questions, connect you with our panelists, and show you how BNPL can look like for your credit union.