Integra First Federal Credit Union (Integra First), a financial institution with over $129 million in assets and serving over 11,000 members in Michigan and Wisconsin, announced that it has added Buy Now, Pay Later (BNPL) to its suite of online banking products.

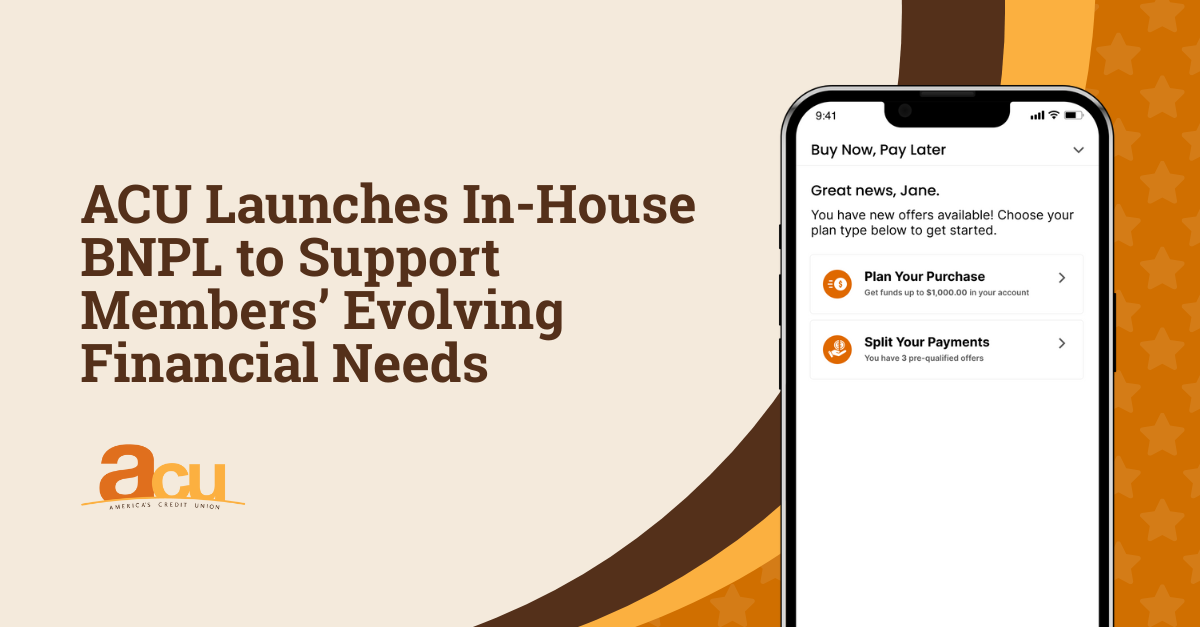

Integra First has selected equipifi, a leading BNPL platform designed for financial institutions, to power its solution. Now, whenever Integra First members make eligible purchases on their existing credit union debit card, they will be able to split the payments for these transactions over time. Through equipifi, Integra First’s BNPL program generates offers that are personalized to each member’s financial context and goals, meeting them where they are with timely access to extra funds when they need it. Members will be able to view and accept their BNPL offers in their digital banking experience, and receive the funds in their checking account in moments.

“At Integra First Federal Credit Union, we provide our members with financial tools that are personalized to their needs and can meaningfully enhance their lives,” said Mindy Brezko, CEO at Integra First. “By bringing flexible financing to the same debit cards and online banking our members use and trust, we are positioned to meet our members where they are. equipifi’s platform helps us do so in a safe and convenient way.”

“BNPL is a must-have tool for consumers to stretch their budget and to achieve their long-term financial goals. For years, they have been asking for it from their trusted financial institutions,” said Bryce Deeney, CEO and co-founder of equipifi. “Credit unions have been quick to respond with the solution their members need. By launching BNPL, Integra First Federal Credit Union is committing to a better banking experience for their entire membership.”

Over sixty credit unions have launched their own BNPL product to their members. equipifi’s data shows that over 81 percent of members continue to use BNPL in year two, with overall usage increasing by 38 percent. In the US, BNPL is projected to grow at a compounded annual rate of 25.5 percent between 2022-2026.

About equipifi

equipifi is the leading Buy Now, Pay Later (BNPL) platform for financial institutions in the United States. This is a white label solution designed to align with consumer purchase habits, payment preferences, and financial goals. The equipifi platform seamlessly integrates with leading banking cores and digital banking platforms to deepen customer engagement, grow market share, increase revenue, and provide a single place to view, accept, and manage BNPL plans on their existing banking app. For more information, please visit http://www.equipifi.com/.

.png?width=70&name=MicrosoftTeams-image%20(1).png)

SHARE